The window to secure the best possible tax benefits for your generosity closes sharply at 11:59 PM on December 31st. As the year concludes, understanding the mechanics of charitable deductions isn’t just about saving money—it’s about maximizing the resources available to organizations like HC4A, allowing your donation to create the greatest possible impact on our programs.

The Strategic Importance of Year-End Timing

Charitable contributions must be completed by the close of business on December 31st to be counted for the current tax year. The core benefit comes from deductions that reduce your taxable income.

1. Key Deductions for All Itemizers

If your total itemized deductions exceed the standard deduction, every dollar you contribute to qualified organizations ( 501(c)(3) charities like HC4A) reduces the income upon which you pay federal tax.

2. The Power of Appreciated Assets: The "Double Win"

This is one of the most tax-efficient giving strategies for donors with investments:

- What to Donate: Stocks, mutual funds, or other non-cash assets you’ve held for more than a year that have significantly increased in value.

- The Double Benefit:

✧ You receive an income tax deduction for the asset’s full fair market value.

✧ You avoid paying capital gains tax on the asset’s appreciation.

By choosing to donate appreciated stock over cash, you increase your donation’s value for the charity and your tax savings simultaneously.

3. Using Donor-Advised Funds (DAFs) for Planning

A Donor-Advised Fund (DAF) acts like a personal charitable savings account. Contributing to a DAF by year-end secures an immediate tax deduction for the current year. The funds are then invested tax-free, and you can recommend grants to charities over time.

This tool is perfect for “bunching”—a strategy where you aggregate multiple years’ worth of donations into a single year to ensure your total itemized deductions surpass the standard deduction threshold.

Special Benefits for Senior Citizens: QCDs and RMDs

For seniors, especially those in retirement, charitable giving offers powerful, specific advantages that often trump standard itemized deductions.

Understanding RMD (Required Minimum Distribution)

The RMD is the mandatory amount of money the IRS requires you to withdraw from your Traditional IRA and certain other retirement accounts once you reach age 73. This withdrawal is typically treated as taxable income, which can raise your overall tax bill and even increase your Medicare premiums.

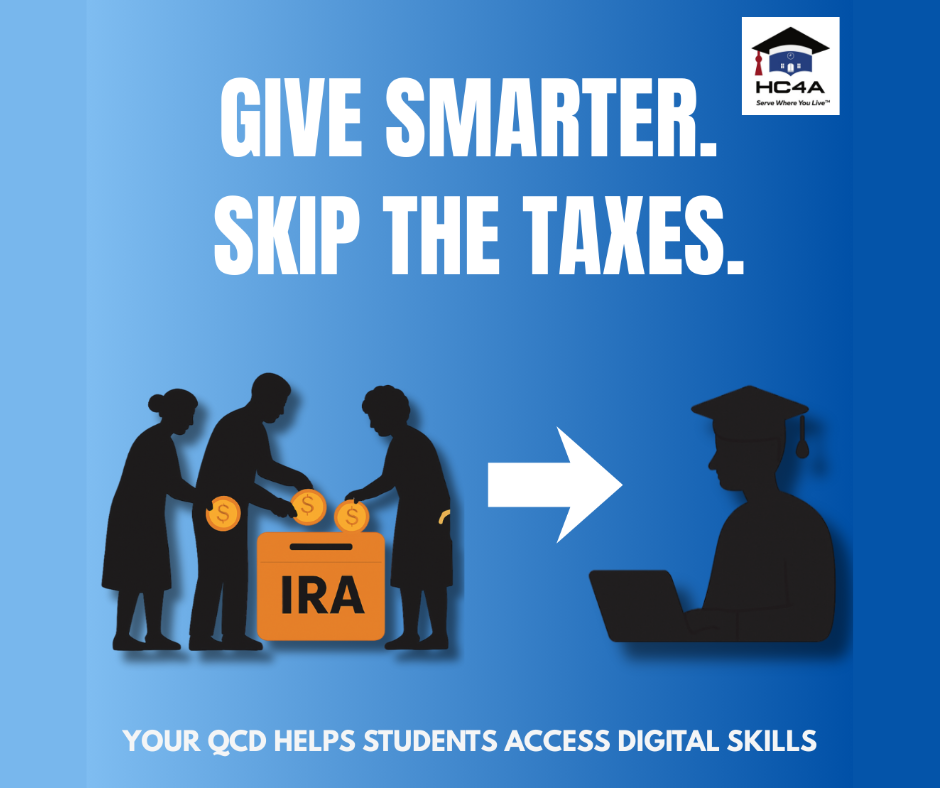

The Superior Strategy: Qualified Charitable Distributions (QCDs)

A QCD is a direct transfer of funds from your Traditional IRA to a qualified charity.

- Eligibility: Available to seniors aged 70 1/2 and older (even before RMDs are required).

- Key Advantage: The money transferred is excluded from your taxable income (up to an annual limit of $108,000 for 2025). This is key because it benefits you even if you take the standard deduction.

- Satisfies RMDs: If you are age 73 or older, the QCD will count toward satisfying your RMD for the year.

- Reduced AGI: By excluding this money from your income, your overall Adjusted Gross Income (AGI) is lower. A lower AGI can lead to less Social Security income being taxed and potentially lower income-based Medicare premiums.

For donors 70 1/2 and up, a QCD is the single most effective way to give

Your Legacy, Our Mission: Directing Your Tax-Smart Gift to HC4A

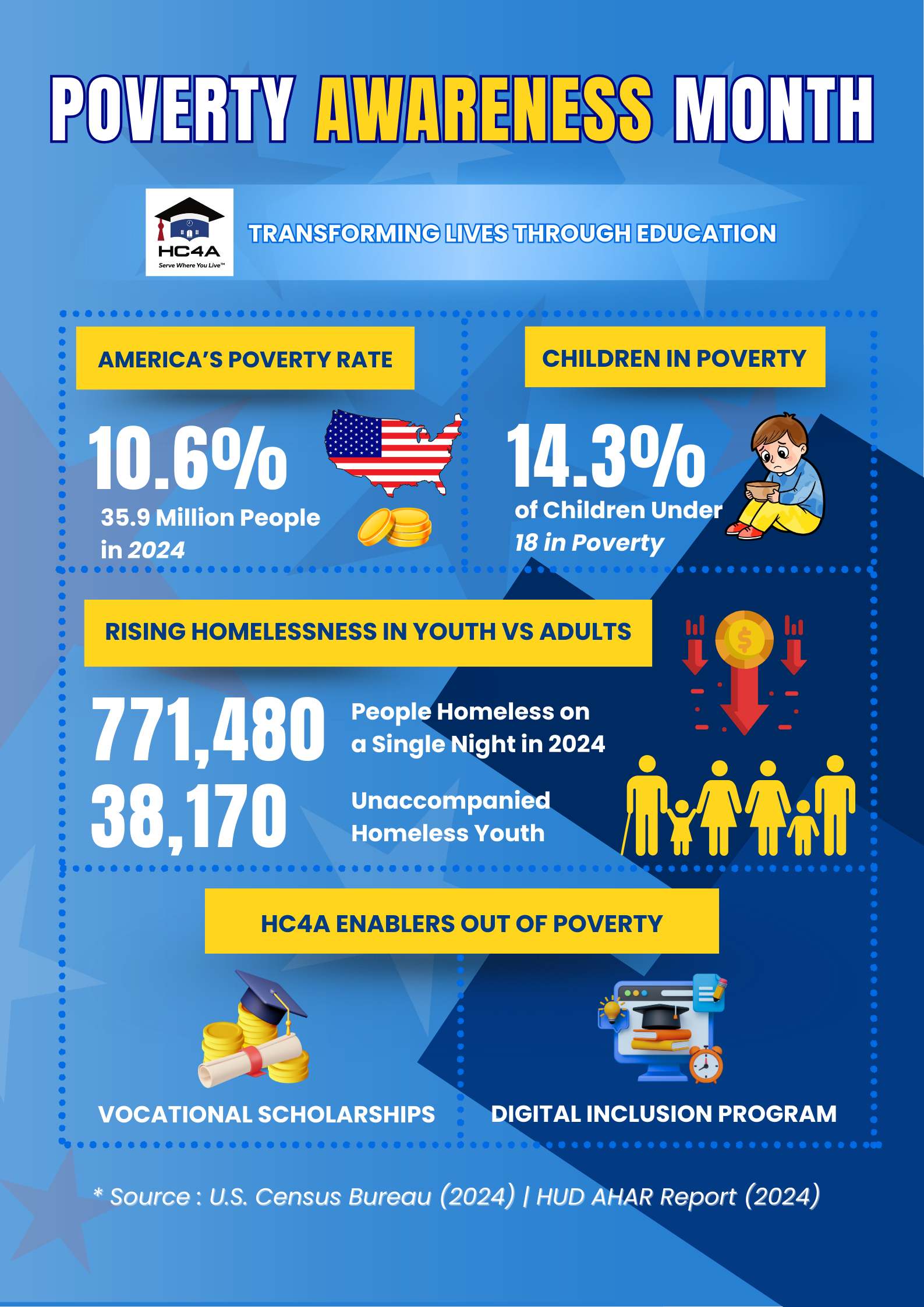

Your tax-efficient gifts don’t just reduce your tax liability—they provide the vital, sustainable resources that power HC4A’s programs. As you structure your year-end giving, consider directing your support to these impactful areas:

- Digital Inclusion Program: Help bridge the technology gap for underserved communities. Donations toward this program fund essential and advanced digital skills training, ensuring youth living in families below poverty level are ready for the jobs today’s economy demands.

- Vocational Scholarships: Your contribution can directly fund vocational scholarships for high-demand skilled trades. These scholarships provide pathways out of poverty and equip students with valuable, marketable skills, changing the economic trajectory for entire families.

- Legacy Scholarship Fund: Consider making a contribution to establish or augment our Legacy Scholarship Fund. This is a powerful opportunity to ensure your impact lasts forever. By making a major year-end gift using appreciated stock or a QCD, you can endow a scholarship in your or a loved one’s name, guaranteeing that future generations of students receive the support they need year after year.

By planning your year-end charitable strategy today, you can maximize your tax savings while making a lasting investment in the educational and technological empowerment of the communities we serve.

*Disclaimer: The information provided here is for general educational purposes and does not constitute tax or legal advice. Tax laws are complex and change frequently. Please consult with a qualified tax advisor or financial planner to discuss your individual situation and ensure you maximize your specific tax benefits.